I remember the first time I stumbled upon cloud accounting software like it was yesterday—mostly because it was the day I realized I’d been living in a financial Stone Age. Picture me, surrounded by a sea of crumpled receipts, desperately trying to make sense of my business expenses while the seagulls outside laughed at my plight. My accountant’s voice echoed in my head, “Eva, you really should consider something more… modern.” So, with a sigh and a little eye roll, I dove into the world of cloud accounting, half-expecting it to be as thrilling as watching paint dry. Spoiler alert: it was, but with a few hidden gems that caught me off guard.

Now, don’t get me wrong—I’m not here to sell you dreams of effortless bookkeeping bliss. But, I will say this: once you get past the jargon and the initial dread, cloud accounting has its merits. In this article, we’re going to explore the messy beauty of what this software can really do: from making invoicing less of a hair-pulling ordeal, to ensuring expense tracking doesn’t turn into a treasure hunt. We’ll dive into the nitty-gritty of reporting without losing our sanity, and maybe, just maybe, find a way to make numbers dance like the waves I love so much. Stick around—it’s going to be a journey worth taking.

Table of Contents

The Day I Realized My Spreadsheets Were Plotting Against Me

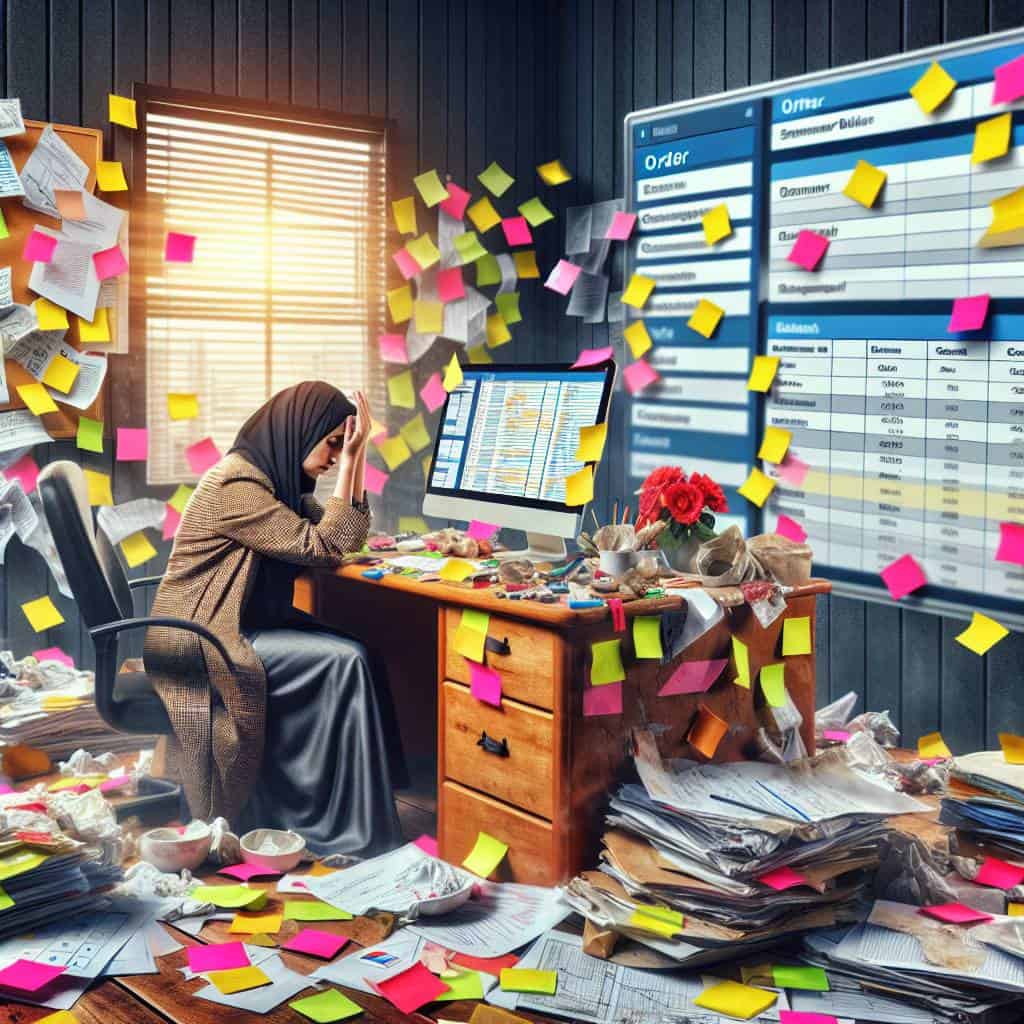

There I was, staring at the glowing screen, the hum of my laptop as relentless as the waves crashing against the shore outside my window. The spreadsheets—those classic green grids that once seemed so innocuous—were now mocking me with their quiet insubordination. Columns and rows, once allies in the battle against chaos, had become a labyrinth of misplaced numbers and phantom expenses. It was a revelation as stark as a gull’s cry cutting through the morning fog: my spreadsheets had turned against me. Or perhaps, they had simply revealed their true nature—unforgiving beasts demanding more time and patience than a person could reasonably offer.

This treacherous epiphany came on the heels of yet another late-night invoice reconciliation session, an odyssey through missing receipts and nonsensical totals that left me questioning my sanity. Expense tracking had become a scavenger hunt with no treasure at the end, just a mess of paper trails leading nowhere. And reporting? A cruel joke. I realized then that spreadsheets were like the sirens of ancient myth, luring me with promises of organization and clarity, only to dash those dreams upon the jagged rocks of reality. It was time to abandon ship and embrace the modern marvel that is cloud accounting software. Because let’s be honest—if we’re going to navigate the turbulent seas of financial management, we might as well have a compass that doesn’t lie.

Taming the Digital Sea: My Final Reckoning

So here I am, standing on the precipice of digital order, the salty breeze tugging at my hair like a mischievous friend. Cloud accounting software isn’t the villain I painted it to be, though it certainly tried on the role. It’s more like the grumpy lighthouse keeper who begrudgingly guides you through the fog. I still have my quibbles with its inscrutable menus and its uncanny ability to predict every expense I conveniently forget. But it’s become a part of my seafaring toolkit, a necessary evil wrapped in binary code.

As the sun dips below the horizon—painting the sky in hues only nature can conjure—I realize that this software, with its sterile promises of ‘streamlined invoicing’ and ‘efficient tracking’, has taught me something unexpected. It’s not about the numbers, the graphs, or the endless reports. It’s about navigating the chaos with a bit more clarity, anchoring myself in the unsteady waters of digital finance. And maybe, just maybe, embracing the messiness of it all. Because, like any good sailor knows, it’s in the unpredictable waves where the real adventure lies.